Hit enter to search or ESC to close

8 November 2024

Pricing relief for insurance buyers

In the final quarter of 2024, the insurance markets began showing signs of softening with more moderate premium increases being applied to many risks.

This shift followed several years of increasing pricing pressure on nearly all areas of insurance, predominantly driven by:

- Higher inflation as a hangover from the Covid pandemic

- Supply chain issues caused by the unstable geopolitical

landscape - Increased global catastrophic losses

- A major reset in reinsurance pricing in January 2023

- Two extreme weather events in New Zealand in Q1 2023.

Inflation has started to ease and, whilst there is still geopolitical instability, supply chains have returned to a more normal basis or at least a ’new normal’.

Similarly, losses from global climate events haven’t slowed down but the insurance and reinsurance markets have now adapted to a new baseline of catastrophic natural disaster planning for any given year.

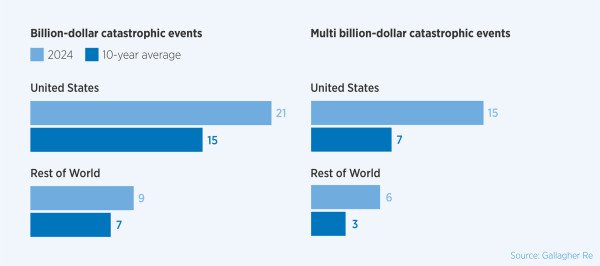

Gallagher Re’s table below shows that in 2024 there were more major catastrophic insured events than the rolling ten-year average. However, the 2023 restructure of reinsurance arrangements and pricing increases meant the global insurance market could sustain these losses.

This is great news for insurance buyers as it demonstrates stability in both the global and local insurance markets.

This stability is further evidenced by the fact the 2025 Los Angeles area firestorms haven’t resulted in a market change, despite the estimated US$52 – 57 billion insured losses emanating from these terrible fires.

In New Zealand, the 2023 Auckland Anniversary floods and Cyclone Gabrielle losses cost the insurance market around NZ$3.75 billion. Since then, however, the Australian and New Zealand-based insurers have benefited from a period of relatively benign claims activity.

Premium increases during 2023 and 2024 have helped insurance companies return to profitability. The two largest insurers operating in New Zealand are IAG and Suncorp. They trade through various brands but in the commercial world it is mainly as NZI and Vero respectively.

Both IAG and Suncorp reported significantly improved underwriting results in their 2025 half-year results at 31 December 2024. The IAG Group across ANZ saw a net profit after tax increase of 91.2% year-on-year and Suncorp Group’s net profit after tax increased 89%.

The results of these companies are reflected in most global insurer and reinsurer performances. These strong performances attract more capital into the marketplace, which in turn drives increased competition.

There are relatively few levers to pull when trading insurance as a commodity. The main ones are:

- How much insurance you can buy – capacity

- How much insurance you retain – excesses

- How much insurance costs – premiums

Policy coverage is also a critical aspect but when insurance companies start competing for business, the main focus is on these three elements.

Across many aspects of commercial insurance, particularly with Material Damage and Business Interruption covers, insurers are now willing to negotiate on premiums, whereas in the past two or three years they have often been inflexible.

On higher-value commercial risks, the London insurance market is proving to be highly competitive as insurers seek to diversify their portfolios to avoid being too US-centric. This in turn is creating competitive tension in the local insurance market, which is keen to retain market share and prevent capacity shifting offshore.

This is great news for clients. For risks with a good claims record there are generally no longer premium increases coming at renewal in 2025. Of course there will be exceptions to the rule but overall the market is swinging in favour of the insurance buyer.

To obtain the best outcome from the market, we still recommend early engagement with your broker who will be able to help create a comprehensive submission and advise on the most effective strategy for market engagement to take advantage of market conditions

As ever, it is important that clients engage with their broker early in the renewal cycle. This ensures their risk can be presented to the market in the best possible way so full advantage can be taken of the current market conditions.

For more insights, read the full report.